Financial Services: Data-driven Multi-Channel Marketing

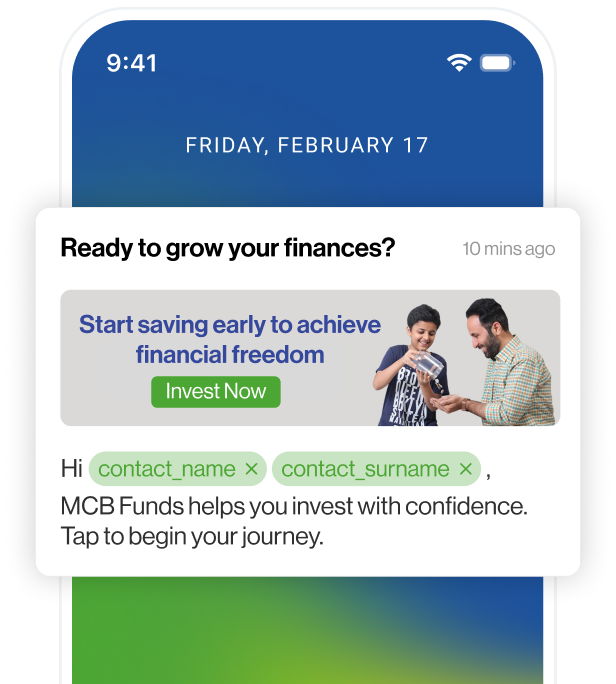

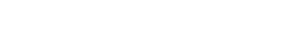

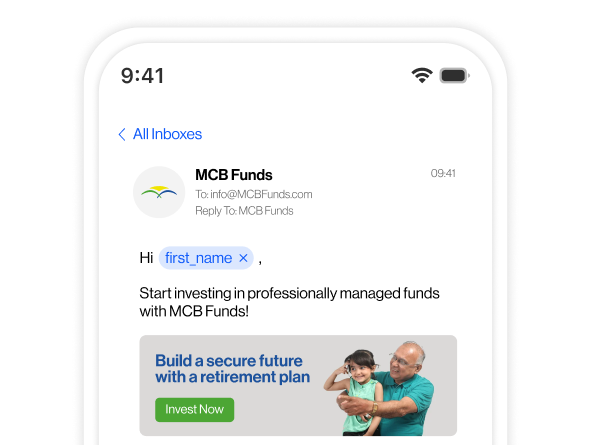

MCB Funds Transforms Digital Engagement with D•engage

MCB Funds, one of Pakistan’s leading asset management companies, serves over 200,000 customers with a diverse range of investment solutions.

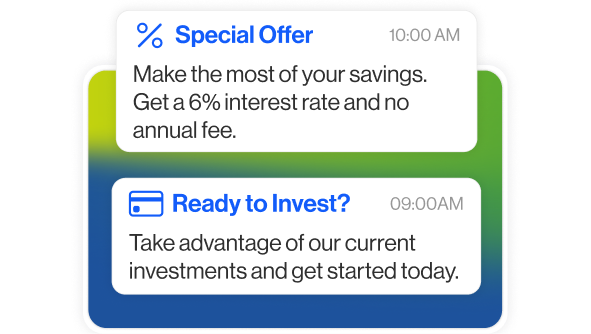

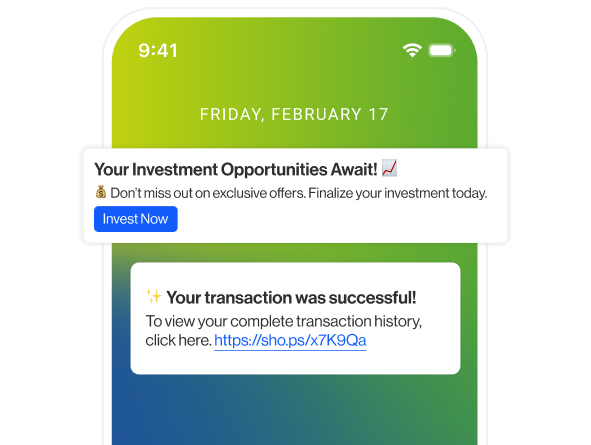

D•engage focused on delivering a smooth onboarding process and a seamless digital experience, as MCB Funds set out to enhance customer engagement, improve segmentation, and create more personalized financial journeys through a data-driven approach.