Financial Services: Data Unification & Real-time Personalization

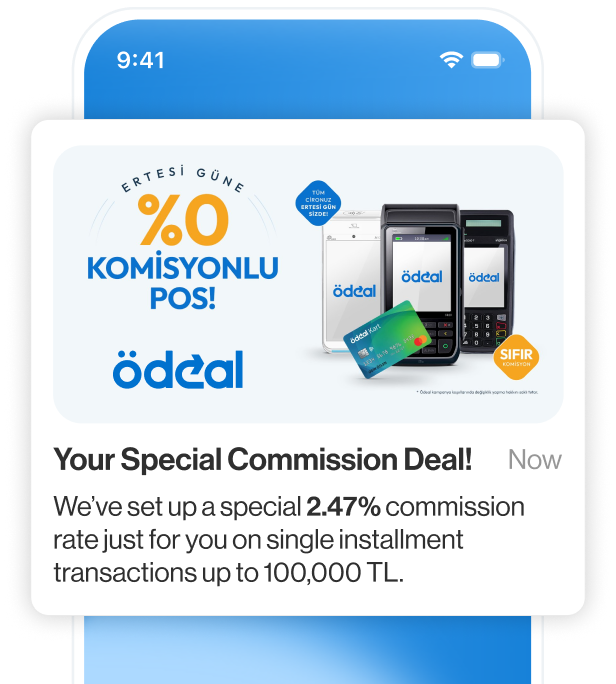

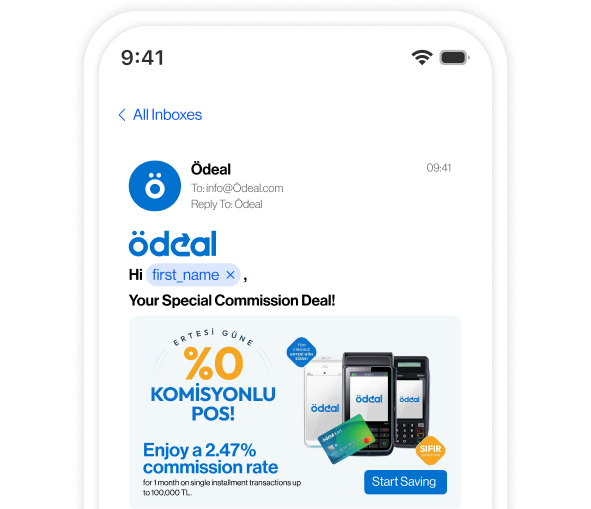

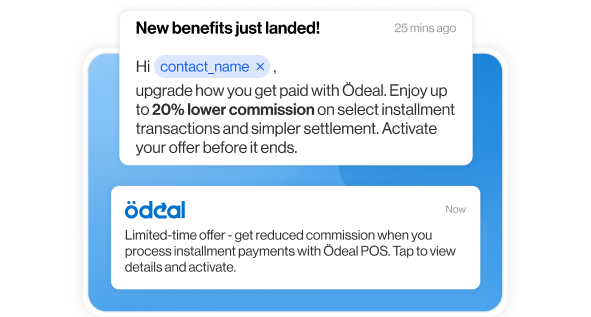

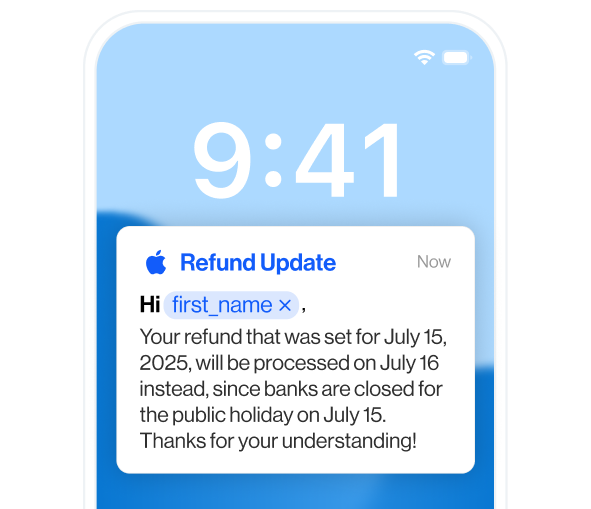

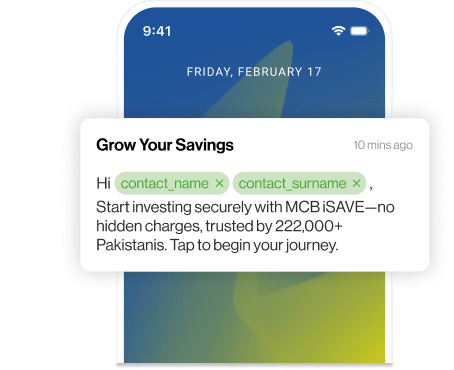

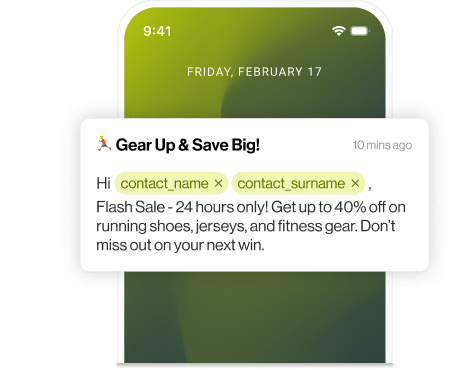

Ödeal’s Transformation Journey: Driving SME Growth with D·engage

Ödeal, one of Türkiye’s most innovative PayTechs, empowers micro businesses and SMEs with both physical and digital payment solutions.

By implementing D·engage’s on-premise Customer Data Platform (CDP), Ödeal eliminated manual inefficiencies, unified fragmented systems, and unlocked real-time personalization, laying a scalable foundation for growth.