Marketing Automation & Customer Experience Data Platform

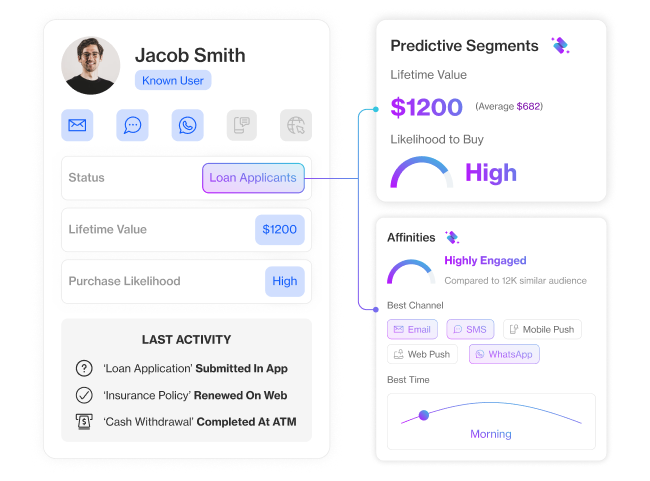

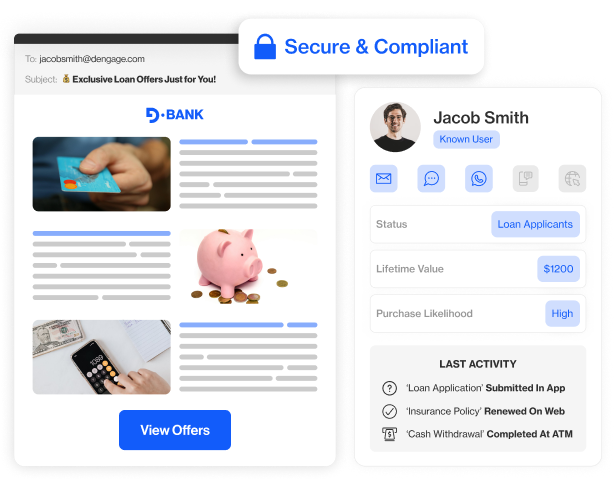

Re-imagine Financial Engagement with Data and Trust

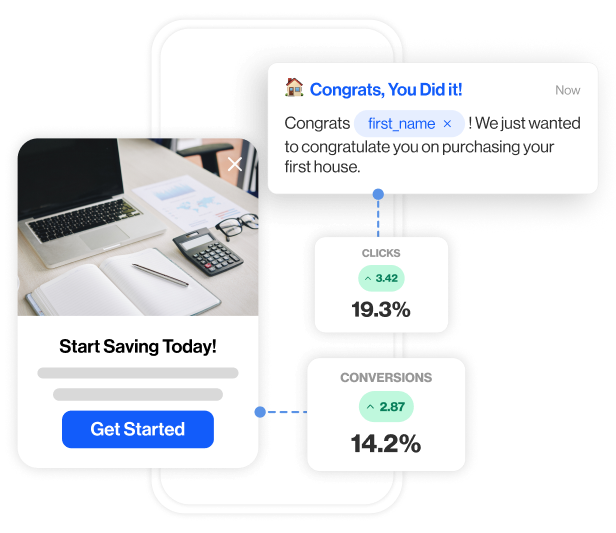

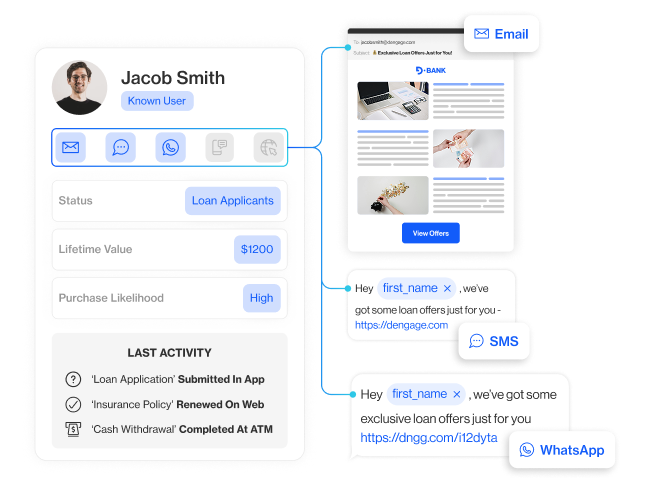

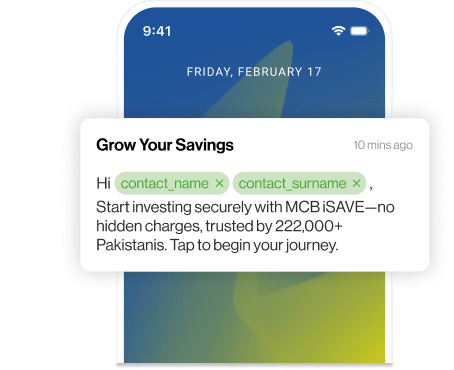

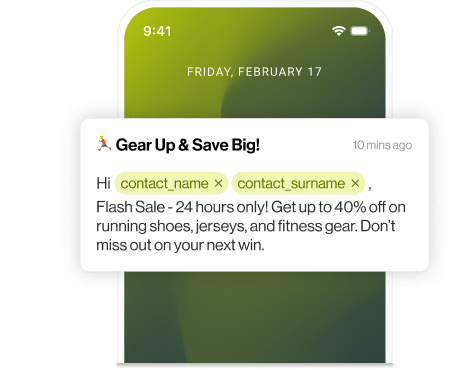

Deliver personalized financial experiences that inspire loyalty and growth.

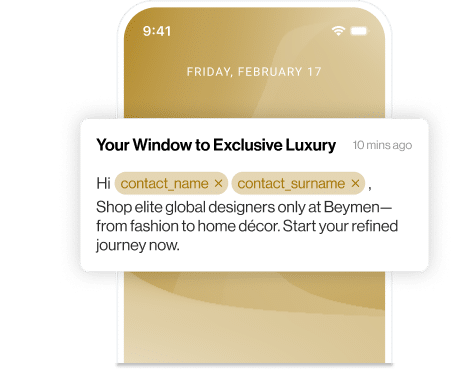

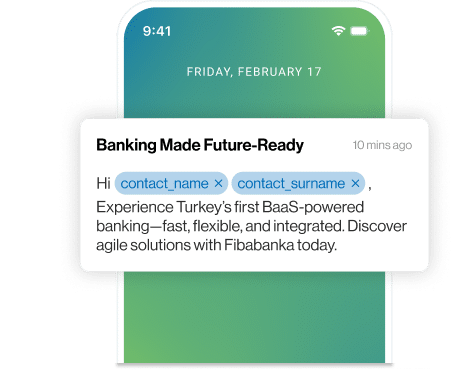

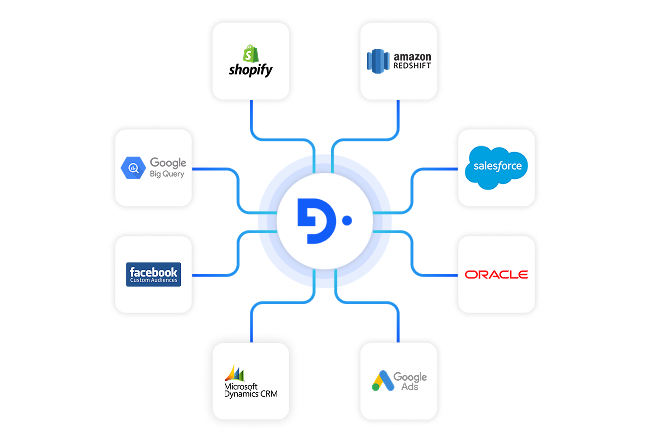

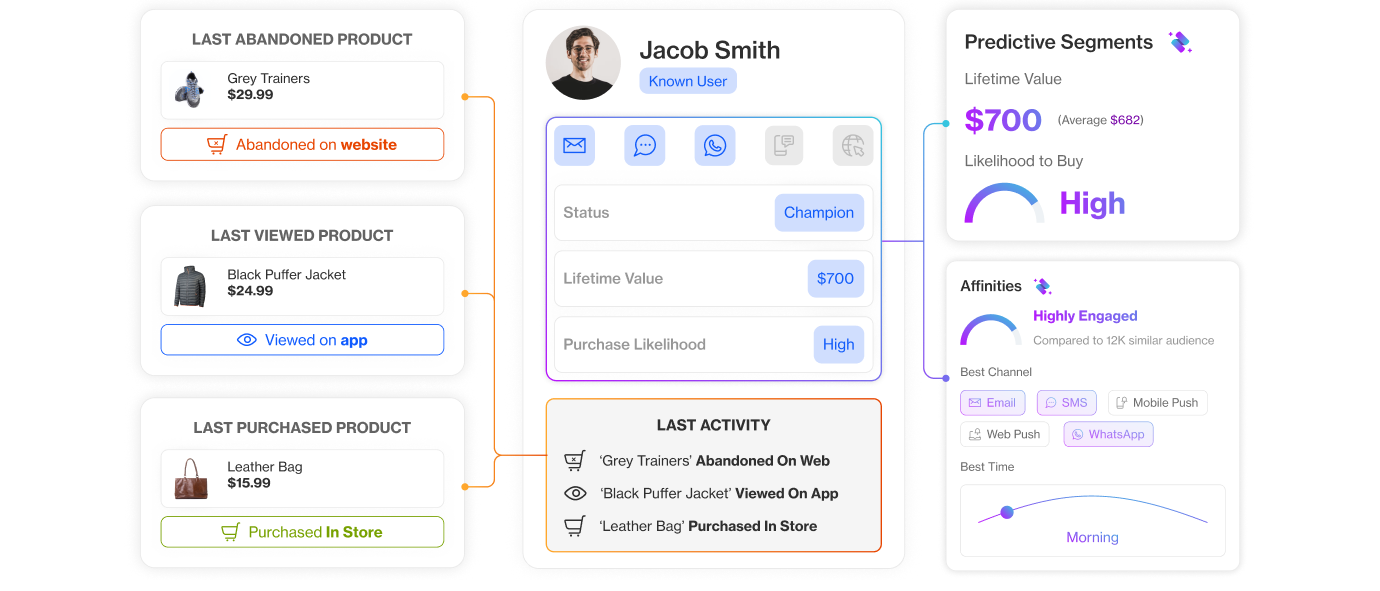

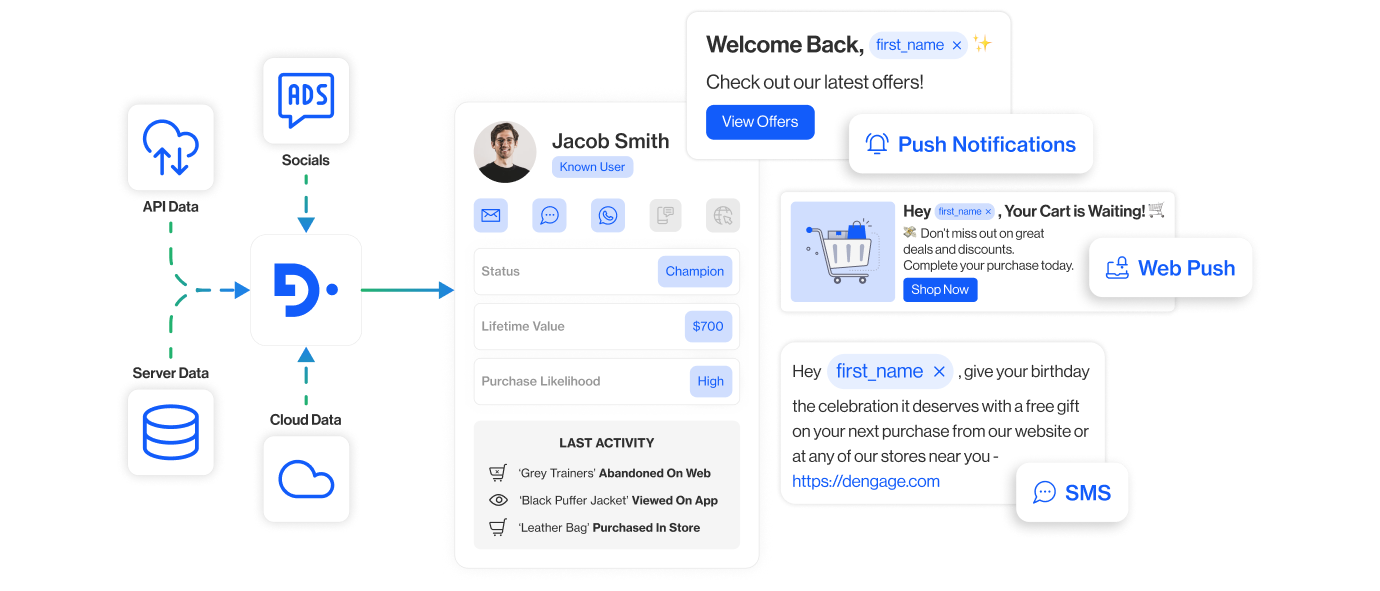

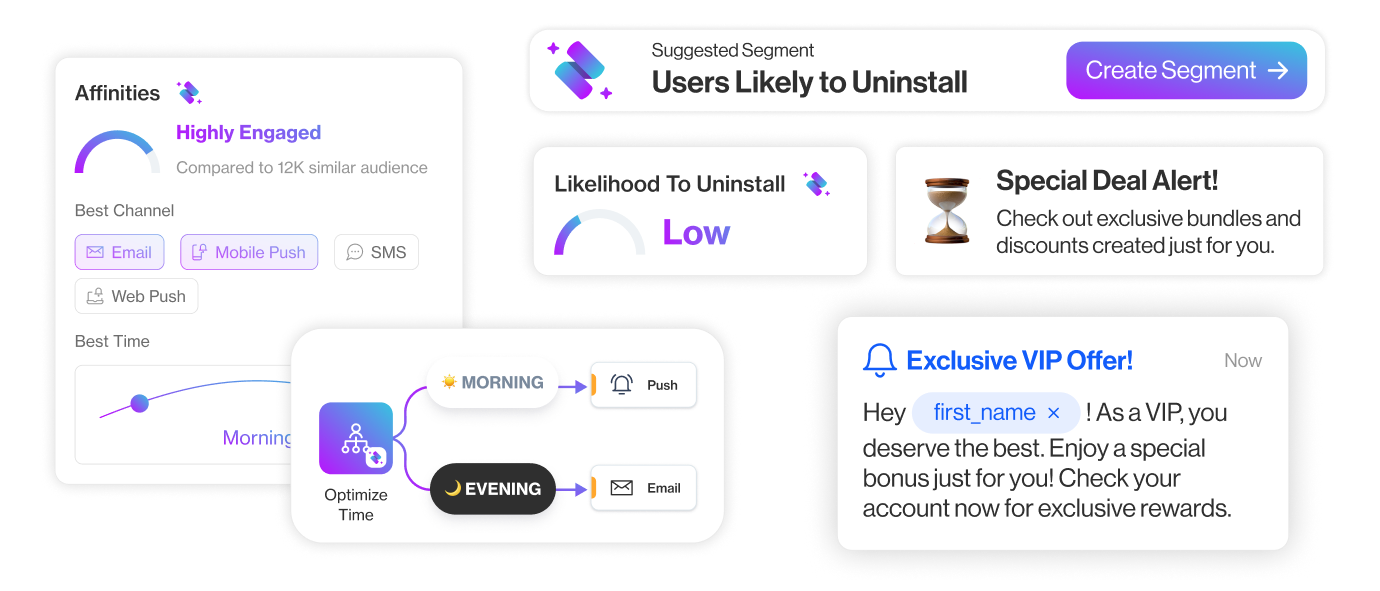

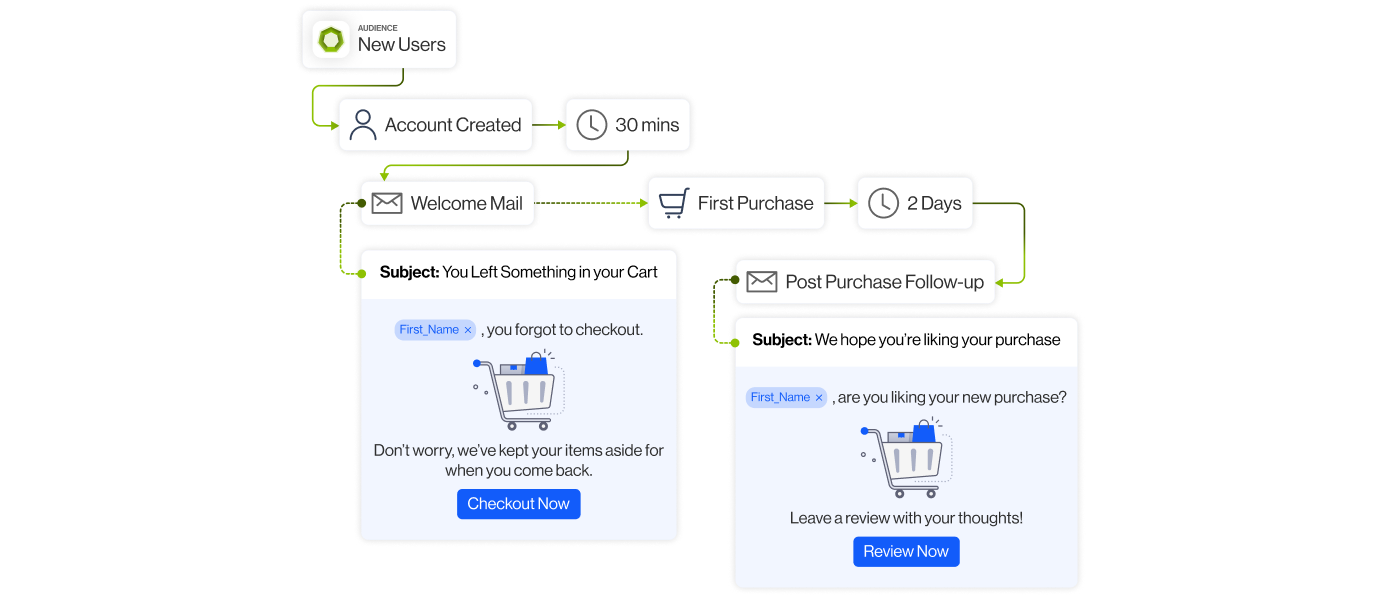

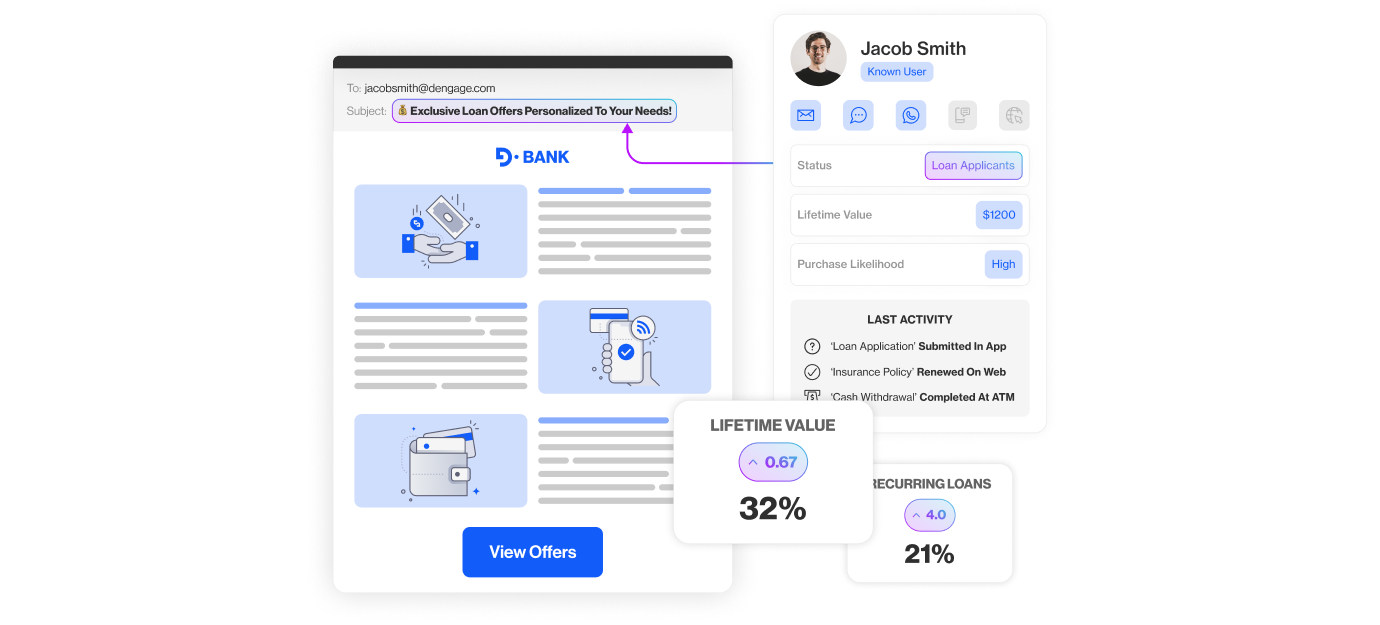

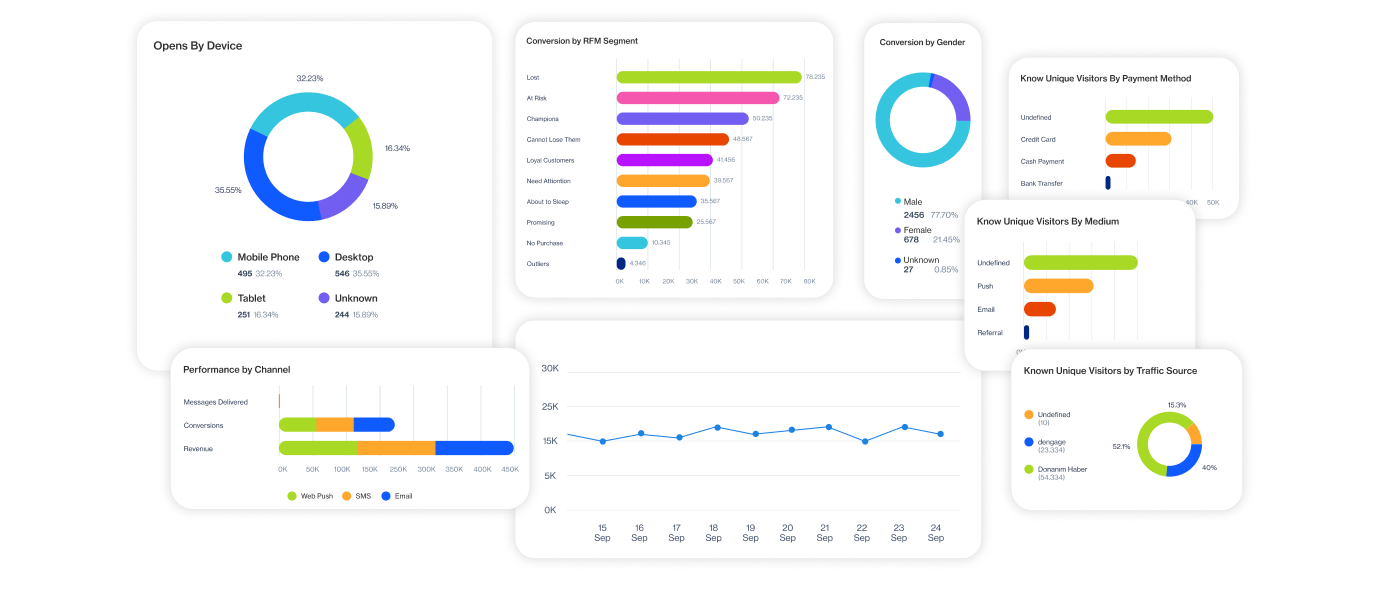

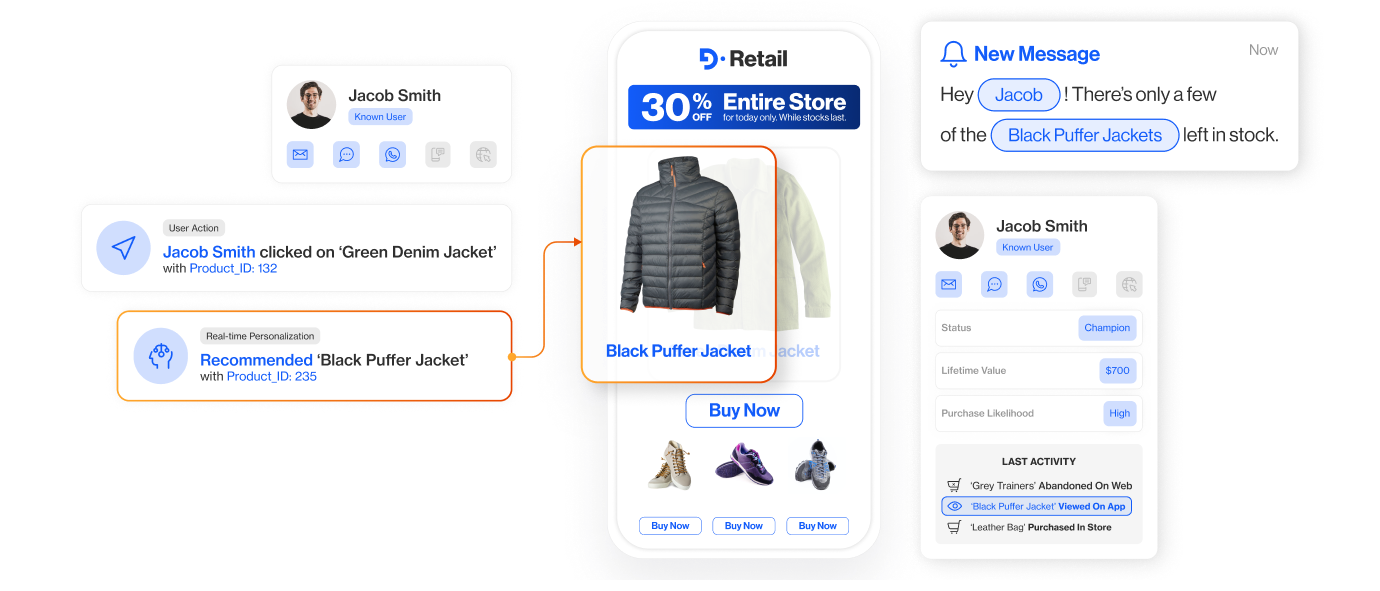

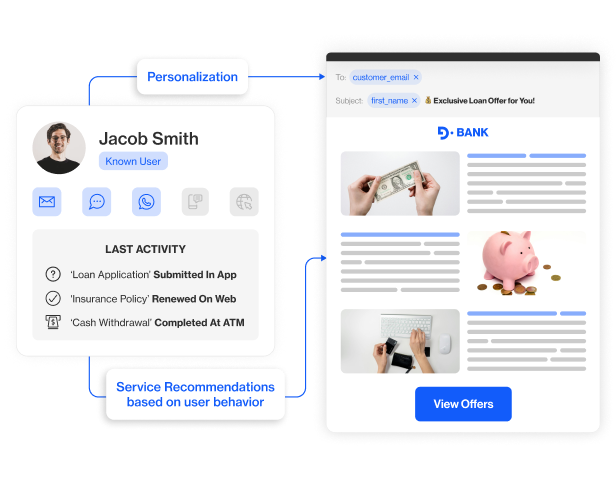

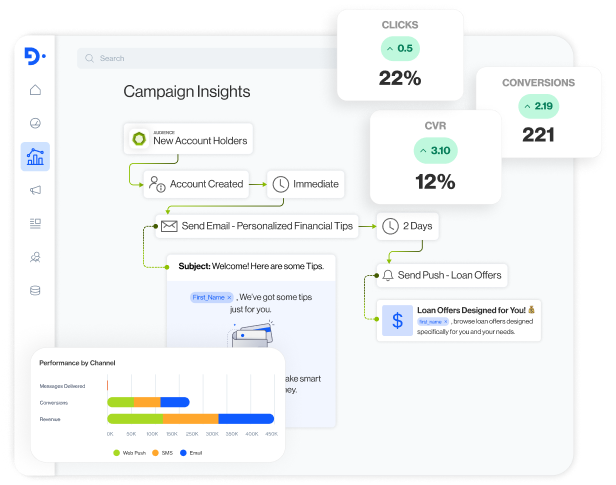

D·engage helps banks, insurers, and fintech brands unify customer data, anticipate needs, and automate compliant omnichannel journeys that deepen relationships and drive measurable ROI.